There are two categories that make up depreciation deductions - capital

works (division 43) and plant and equipment (division 40).

What are capital works deductions?

Capital works deductions are income tax deductions an investor can claim for the wear and tear that occurs to a building’s structure and items considered to be permanently fixed to the property. This includes any structural improvements that may have been made during a renovation within relevant dates. They can be claimed even if completed by a previous owner.

Capital works deductions remain unaffected by legislation introduced on 9 May 2017 and can continue to be claimed for all properties. They typically make up between 85 – 90% of a total depreciation claim.

What is deductible under capital works?

Capital works deductions cover items such as:

Residential property

- Built-in kitchen cupboards

- Doors, locks and door handles

- Clothes lines

- Bricks, mortar, walls, flooring and wiring

- Driveways

- Fences and retaining walls

- Sinks, basins, baths and toilet bowls

Commercial property

- Ducting for air-conditioning

- Mezzanines

- Bricks, mortar, walls, flooring and wiring

- Car parks

- Sinks, basins, baths and toilet bowls

Certain assets can cause confusion because some parts will qualify for plant and equipment depreciation while other parts qualify for capital works deductions. An example of this is an air conditioning unit, where the unit itself depreciates under division 40 while the ducting for the same unit falls under division 43. A qualified quantity surveyor such as BMT Tax Depreciation can help in this area.

Capital works depreciation rates

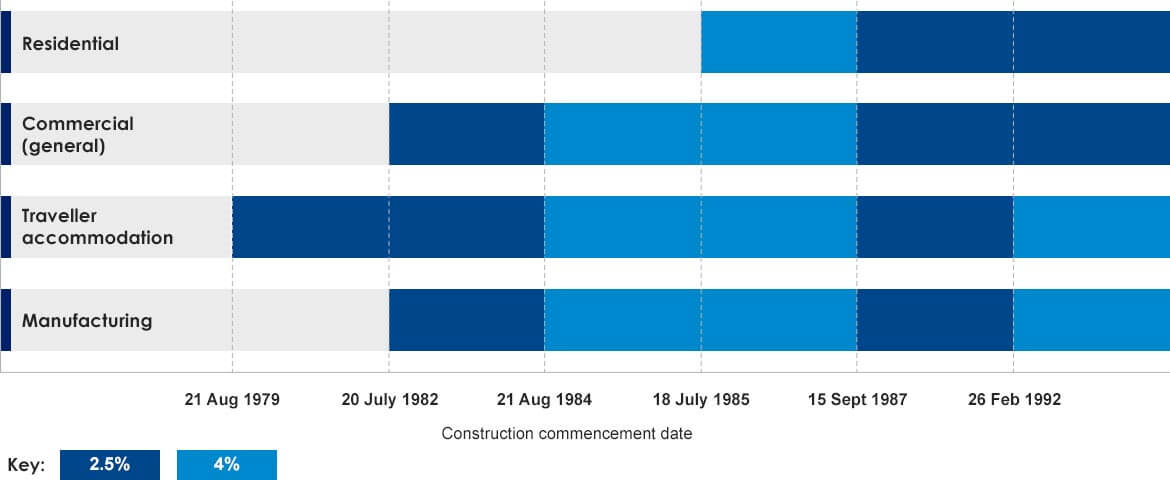

Different rates apply for different properties based on property type, construction commencement date and industry. As a general rule, capital works deductions apply to:

Residential properties

At a rate of 2.5 per cent per year for up to 40 years where construction commenced after 15 September 1987

Commercial properties

At varied rates where construction commenced after 20 July 1982

The below table outlines which rate is available for different properties, based on their industry and construction commencement date

If your property was constructed before these dates, it’s still important to get in touch with us as often these buildings have undergone some form of renovation which can result in capital works deductions for the owner.

A BMT Tax Depreciation Schedule will ensure you’re maximising the depreciation deductions for your property. The schedule covers all deductions available over the lifetime of a property and is 100 per cent tax deductible.

Capital works deductions (division 43) FAQs

How is the capital works deduction different to plant and equipment?

Is my property too old to claim depreciation?

It is a common myth that older properties will attract no depreciation claim. However, both new and old properties will hold some depreciation benefits.

A depreciation schedule is the best way to ensure the biggest tax refund possible. A BMT Tax Depreciation Schedule covers all deductions available over the lifetime of a property.

BMT’s specialist staff will assess each property before we start to make sure there are sufficient deductions. In fact, we’ll find double our fee in deductions in the first full financial year or we won’t charge for our services.