There are two methods of calculating depreciation on plant and equipment: diminishing value and prime cost.

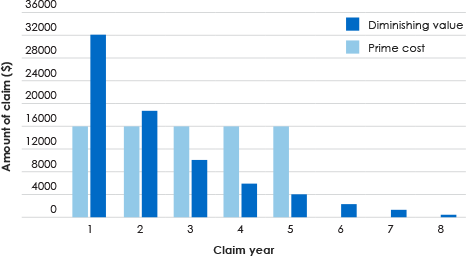

Both methods claim the same amount of depreciation over forty years but achieve different short and long-term cash flow outcomes.

You can only choose one of these depreciation methods for the lifetime of your depreciation schedule, so it is important to understand how this choice will affect your investment before you claim. We recommend that you consult with your accountant or financial adviser to work out which method is best for you.

Diminishing value method

The diminishing value method returns higher depreciation deductions in the first few years of property ownership.

Under this method, the deduction is calculated as a percentage of the balance you have left to deduct. It decreases in value each year, so depreciation claims drop, until assets run out (or are round down to zero).

The formula for calculating depreciation using the diminishing value method is as follows.

After 10 May 2006

Opening un-deducted cost × (days owned ÷ 365) × (200% ÷ asset’s effective life in years)

Before 10 May 2006

Opening un-deducted cost × (days owned ÷ 365) × (150% ÷ asset’s effective life in years)

The diminishing value method uses low-cost and low-value pooling to increase the claim on items under $1,000 and allows investors to claim 100 per cent of the value of items worth less than $300.

Prime cost (straight line) method

Under the prime cost method, also known as the straight-line method of depreciation, the deduction for each year is calculated as a percentage of the cost.

Unlike the diminishing value method, this method returns a straight-line depreciation amount until the full value of assets are claimed. Investors who choose the prime cost method will claim a lower but more consistent proportion of the available deductions over a longer period.

Since this method returns greater deductions in the later years of the depreciation schedule, it suits investors looking to maximise their depreciation claim in later years.

The formula for calculating depreciation using the prime cost method is as follows:

Opening un-deducted cost × (days owned ÷ 365) × (100% ÷ asset’s effective life in years)

A BMT Tax Depreciation Schedule includes both the prime cost and diminishing value methods of depreciation to provide you with the deductions for both methods to help you make an informed decision before claiming.

Depreciation methods FAQs

Which depreciation method is best?

It depends on how you want to claim.

If you claim with the diminishing value method, you are claiming a greater proportion of the assets cost in the earlier years of the effective life. For example, if you purchased the property for the purpose of a short term investment and planned to sell it in five years time, the diminishing value method may be a more attractive option to take, as it provides higher returns over the earlier years. If you claim using the prime cost method, you are claiming a lower but more constant portion of the available deductions over the life of the property. This could be suitable if you were intending to retain the ownership for a longer period of time.

Our experience shows that most investors employ the diminishing value method as depreciation deductions under this method are cumulatively higher over the first five years of ownership. We always recommend that you consult with your accountant or financial adviser to discuss your personal circumstances and investment strategy.