Should you use prime cost or diminishing value?

There are two main methods used to calculate depreciation deductions for plant and equipment assets within an investment property, the diminishing value method and the prime cost method. Plant and equipment assets are items which are easily removable or mechanical in nature such as carpet, blinds and light fittings.

Both methods end up claiming the same amount of depreciation over the life of the property but result in different short- and long-term cash flow outcomes. Each method has its benefits, and the most suitable choice will come down to the investor’s strategy.

Diminishing value method

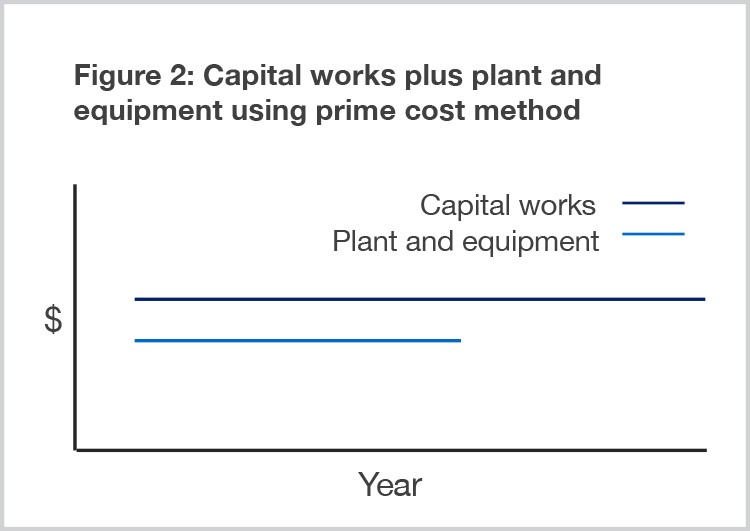

The diminishing value method returns higher depreciation deductions in the earlier years of property ownership.

The diminishing value method calculates deductions as a percentage of the asset’s depreciable balance. Claims for assets will decline each year until the value is rounded down to zero.

The formula for calculating depreciation using the diminishing value method is as follows:

Base value × (days held ÷ 365) × (200% ÷ asset’s effective life in years)

Because legislation allows 200 per cent to be divided by the effective life, the value is increased under the diminishing value method, resulting in higher claims in the early years.

Figure 1 displays how the diminishing value method depreciates assets more quickly in earlier years.

Prime cost method

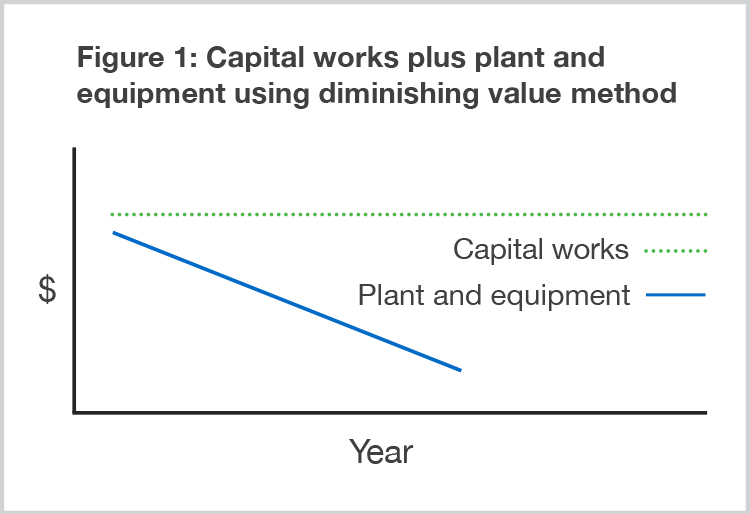

The prime cost method, also known as the straight-line method, deducts assets at a more consistent rate over the life of the asset.

The prime cost method calculates deductions each year as a percentage of the asset’s cost.

The formula for calculating depreciation using the prime cost method is as follows:

Asset’s cost × (days held ÷ 365) × (100% ÷ asset’s effective life in years)

Figure 2 displays how the prime cost method depreciates assets consistently throughout the life of the property.

Which depreciation method is best?

The diminishing value method is traditionally the most popular option because it gives higher returns sooner, giving investors the opportunity to reduce debt faster or reinvest the additional return. Investors who are expecting a higher tax liability in earlier years of owning an investment property may find this method ideal.

The prime cost method may be more suitable for investors wanting to claim consistently throughout the life of the property with a long-term investment strategy, or who expect a larger tax liability in the years to come.

Once a method has been chosen, it cannot be changed. Therefore, it’s important property investors select the most suitable one. A specialist quantity surveyor will provide the figure for both methods and a trusted accountant will help investors decide which method is best aligned with their investment strategy, income expectations and goals.

A BMT Capital Allowance and Tax Depreciation Schedule displays maximum depreciation deductions using both the diminishing value and prime cost methods. When applicable, BMT will also apply relevant legislation to accelerate deductions for qualifying assets, for example, low cost and low value pooling and immediate write off.

To learn more about the depreciation methods, contact BMT at 1300 728 726 or Request a Quote.

The information provided in this article is general in nature and is not financial advice. We recommend consulting an accountant or a financial adviser to discuss your individual investment scenario.