Reduce the risk of financial stress with PropCalc

See how buying a new property will affect your financial position

Despite historically low interest rates, many Australian property owners continue to face mortgage stress. A household is considered to be in mortgage stress when more than 30 per cent of their pre-tax income goes towards servicing a home loan. The Australian Bureau of Statistics considers this to be a financially precarious position.

As rising household debt and a subdued economy contribute to mortgage stress, it’s more important than ever to make informed decisions when purchasing investment property.

Investors need to assess their finances, determine how much they can afford to repay and calculate the holding costs. It’s crucial to do the numbers before purchasing property to see what the out of pocket expenses will be.

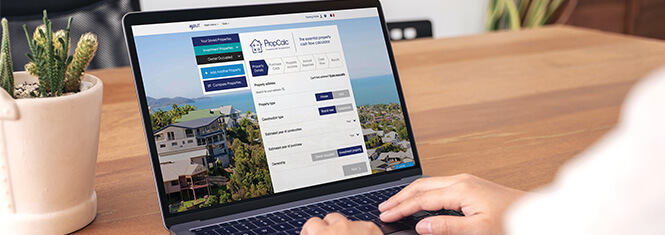

The simple solution is PropCalc, a free online calculator revolutionising property research by using market analysis and automated and customisable data to show exactly how a purchase will affect an investor’s financial position.

Introducing PropCalc

More than just a mortgage calculator, PropCalc allows users to personalise data such as purchase costs, potential property income, expenses and tax deductions. It considers the stamp duty, deposit amount, legal fees, insurance expenses, strata fees, pest and building inspection costs and deductions like depreciation to provide a realistic breakdown of the cost of owning a property.

The tool determines whether a property is likely to be negatively or positively geared based on an investor’s financial situation, helping to choose the appropriate property for any investment strategy. Live market data provides a real reflection of the property value to help investors make an educated decision about what and when to buy.

How it works

Say an investor wants to purchase a house for $500,000 with a 20 per cent deposit. The investor knows based on key suburb data that the house can achieve a rental return of $465 per week or $24,180 annually. The total expenses for the property including council rates, insurances, loan interest and property management fees are likely to equal $24,262.

After using PropCalc, the investor knows their deprecation estimate would be around $13,800 and their total deductions around $15,680. Based on the results, the investor is likely to receive a tax refund of $5,802, resulting in a yearly cash flow of $3,920. The house will be positively geared. This type of insight is invaluable for savvy property investors and can save thousands of dollars in the long term.

Focus on one property or use PropCalc’s ‘Compare’ tool to view, save and assess a range of personalised property reports side-by-side. Sync the data between the desktop and the app and take the results to property inspections. An ideal feature when comparing multiple properties is the ability to upload property photos and add personalised notes from inspections, allowing all property research to be stored in one convenient place.

PropCalc’s customisability and easy-to-use format set it apart from other tools on the market and make it a must-have tool when searching for an investment property. The essential cash flow calculator is available online in MyBMT, a free comprehensive portal designed to help investors and their team manage their depreciation and property needs.

MyBMT allows users to view, update and download tax depreciation schedules, request insurance quotes, receive notification of properties listed in any area and view comparison-based valuations of properties.

To join more than 120,000 people already registered and enjoying the benefits of PropCalc, visit bmtqs.com.au/propcalc today.