Are you exempt from paying Capital Gains Tax?

What to know if you are thinking of selling a property

Before an owner decides to sell their property, they need to be aware of the Capital Gains Tax (CGT) implications that may apply. Surprisingly, many owners are exempt from CGT but are unaware of their situation, so it is worthwhile to do some research.

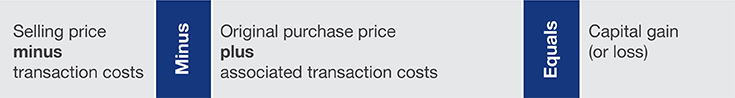

Introduced on the 20th September 1985, CGT is the tax payable on the difference between what it cost you to purchase an asset and the amount you received when you disposed of it.

When you sell a property this triggers a ‘CGT event’. Investors may not be liable for some of the costs involved in paying CGT if they fall within any of the following exemption rules provided by the Australian Taxation Office (ATO).

Six month rule

Under the six month rule the ATO allows you to hold two primary places of residence. An exemption from CGT is available if a new home is acquired before a purchaser disposes of the old one. In this instance both dwellings are treated as the primary place of residence for up to six months if:

- The old property was the owner’s primary place of residence for a continuous period of at least three months in the twelve months before it is sold

- The owner did not use the old property to provide an assessable income in any part of the twelve months when it was not the primary place of residence

- The new property becomes the owner’s primary place of residence

If you dispose of the old dwelling within six months of acquiring the new one, both dwellings are exempt for the whole period between when you acquire the new one and dispose of the old one.

Six year rule

If the owner of a primary place of residence chooses to move out of their home and rent it out, a CGT exemption is available for up to six years after they vacate. The ATO list some reasons of when this may occur such as if the owner accepts a job interstate or overseas, is staying with a sick relative long term or is going on an extended holiday. There is currently no limit to the number of times a property owner can reset the exemption rule so long as each absence is less than six years. If you make this choice, you cannot treat any additional dwelling you own as your main residence for that period.

Principal place of residence

Property that is owned by someone who resides, occupies or lives in the property is exempt from CGT so long as the dwelling is used mainly as residential accommodation and is located on land under two hectares in size.

Only one property can be classed as a principal place of residence and therefore exempt from CGT at any one time. However, there are exemptions that apply as outlined under the six month rule.

Fifty per cent discount for property investors

Individuals or small business owners who hold an income producing investment property for more than twelve months from the signing date of the contract before selling a property will receive a fifty per cent exemption from CGT.

It is recommended to consult with an Accountant to find out how claiming depreciation deductions can impact CGT.

If an owner is considering the sale of their investment property they should consult with an Accountant for advice on their individual scenario.