Are you taking full advantage of common property deductions?

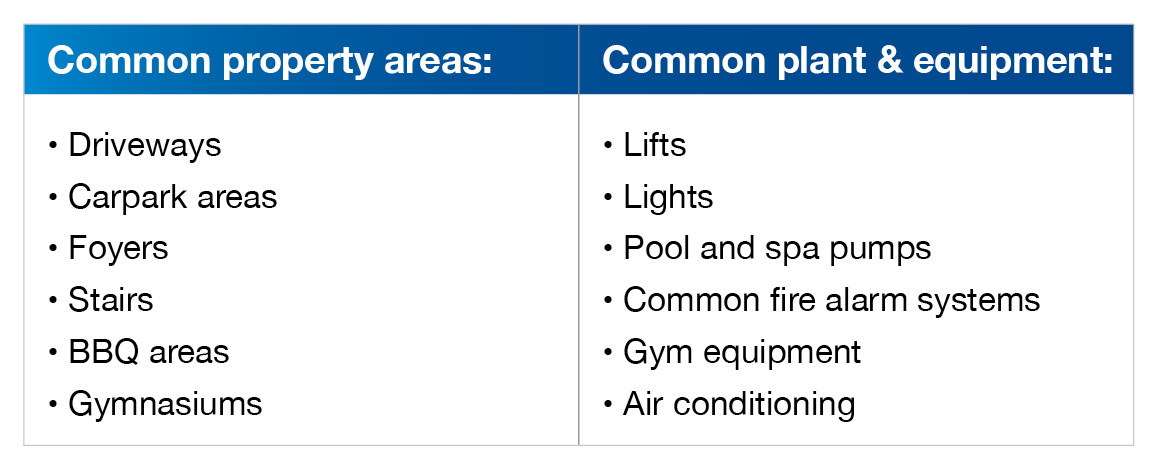

Common property has been identified by the Australian Taxation Office (ATO) as areas within an apartment complex or development that are shared between owners. Common areas are nominated sections of a complex which all owners are entitled to utilise.

How do common property entitlements increase the depreciation benefit?

Unit owners can save thousands of dollars each year by claiming depreciation on common property within their apartment complex or development.

Common property depreciates in the same way as any other part of the property. Plant and equipment assets (division 40) in common property will depreciate according to their effective lives, which are determined by the ATO. Capital works allowance (division 43) relates to the structural portion of common property and depreciates over 25 or 40 years, depending on the construction date. A taxpayer’s percentage of ownership for common property is calculated using unit entitlements commonly found on the strata plan. The portion of a common item owned is considered an asset in its own right and is depreciated as such. Claiming a percentage of the depreciation on common property adds to the total depreciation claim.

How is a unit owner’s entitlement to common property usually determined?

A unit owner’s entitlement to common property correlates directly to their liability. Common property is usually apportioned depending on a number of criteria such as the size of the unit, its position in the development (penthouse or ground floor unit) and even its view. When a Land Surveyor initially draws up the plan for a development, they calculate each unit’s entitlements.

BMT Tax Depreciation perform a thorough site inspection of common property areas and items. Based on relevant building plans, BMT Tax Depreciation determine the owner’s entitlements. All common plant and equipment items within the development are valued and then apportioned based on the calculated entitlement. It is a complex procedure which should be handled by a specialist Quantity Surveyor.

We are happy to discuss any queries about common property depreciation.